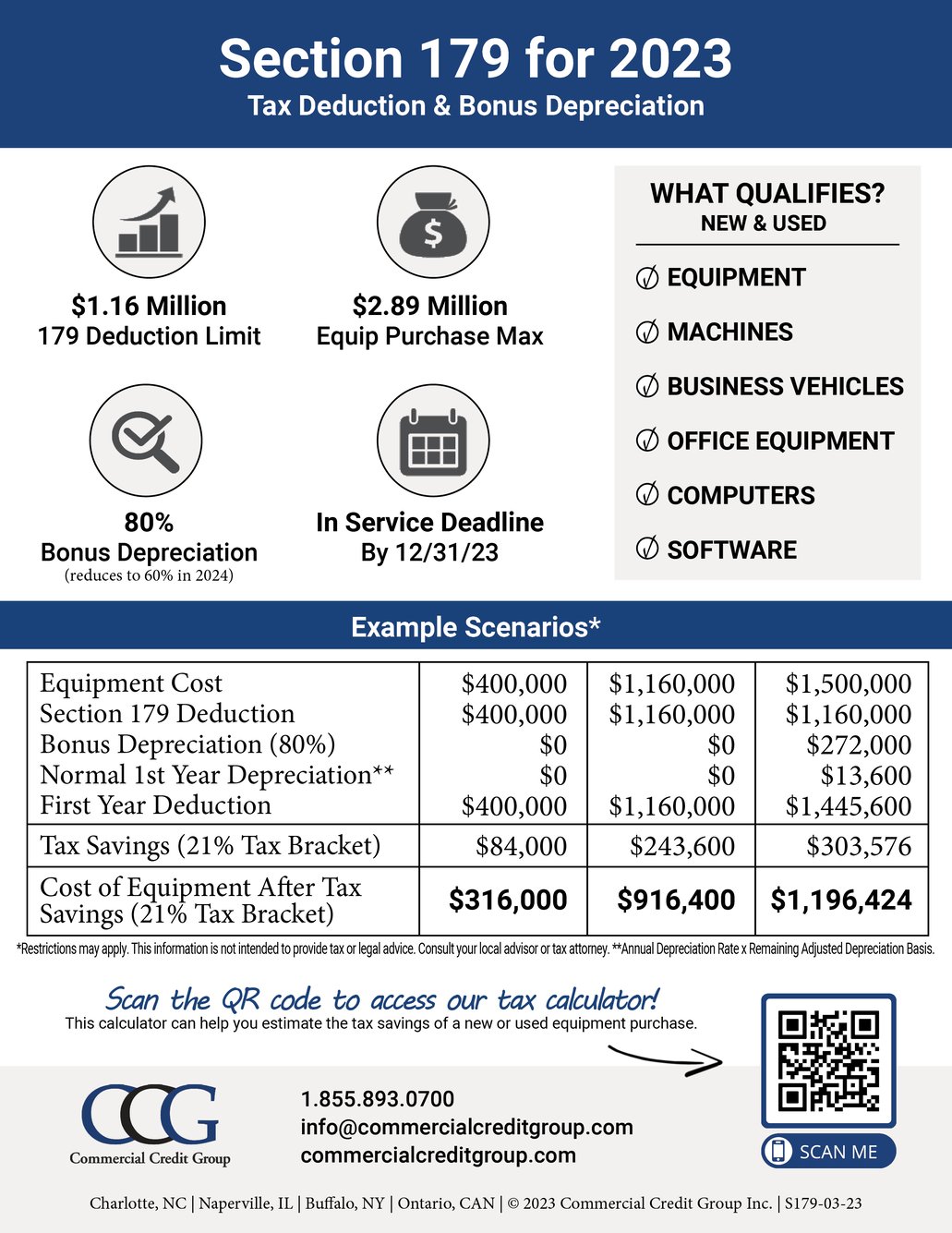

2025 Section 179 Limits Irs. Section 179 at a glance for 2025. The deduction is subject to both a dollar limit and a business income limit, applicable to each.

2025 spending cap on equipment purchases = $3,050,000. This is the total deduction allowed for all eligible new and used equipment purchased.

2025 changes to section 179 and bonus depreciation the section 179 expense provision and bonus depreciation are two of the most important parts of the irs tax code for.

21+ Hsa Contribution Limit 2025 Article 2025 BGH, This chapter explains what property does and does not qualify for the section 179 deduction, what limits apply to the deduction (including special rules for partnerships and corporations), and how to elect it. Section 179 of the irs tax code lets a business deduct the full purchase price of qualifying equipment within the year it’s purchased instead of writing off small.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, Under the 2025 version of section 179, the deduction. It also explains when and how to recapture the.

Section 179 Property Guide for 2025 Balboa Capital, For 2025, the expensing limit will. However, in 2025, the spending cap on equipment purchases for eligibility was.

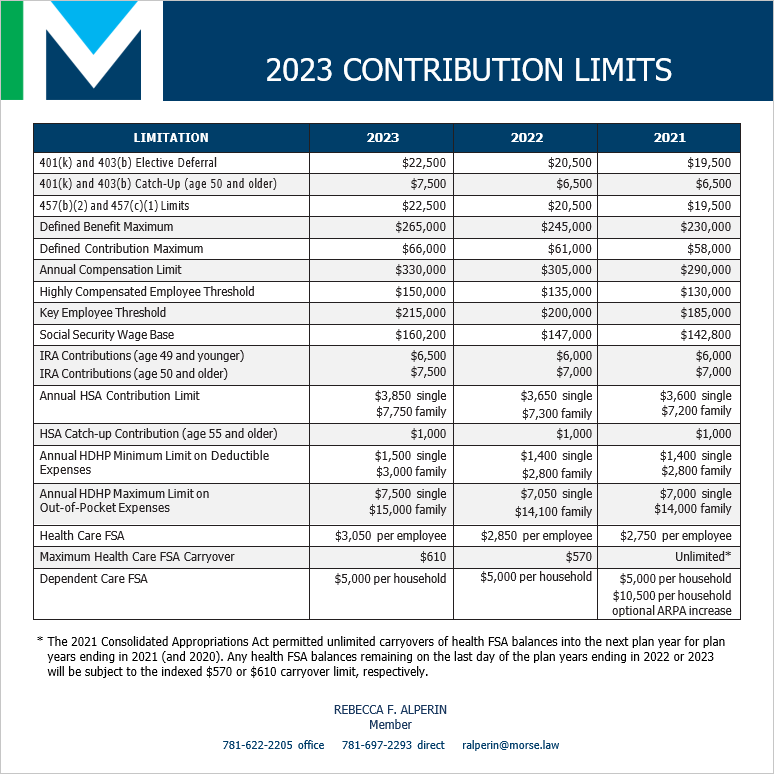

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, It also explains when and how to recapture the. 2025 section 179 deduction limits.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, • what vehicles qualify for the section 179 deduction in 2025? For tax years beginning in 2025, the maximum section 179 expense deduction is $1,160,000.

Employee Benefit Plan Limits IRS 2025 Morse, Under the 2025 version of section 179, the deduction. • can new and used vehicles.

Section 179 of the IRS tax code allows businesses to deduct the full, 2025 section 179 deduction limit in 2025 (taxes filed in 2025), the section 179 deduction is limited to $1,220,000. Section 179 at a glance for 2025.

Section 179 Tax Deduction For 2025 Balboa Capital, Thirdly, there is a limit as to how much can be deducted under section 179. The amount that may be expensed under code sec.

Section 179 IRS Tax Deduction Updated for 2025, It also explains when and how to recapture the. Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),.

The IRS just announced the 2025 401(k) and IRA contribution limits, • what is the list of models exceeding 6,000 lbs that may be eligible for section 179? The maximum deductible amount begins to decrease if more than.